President's Message

Discover a Strategic Approach to Saving Money

Recent economic shifts have changed our financial landscape. Find out how to navigate these changes with specific money-saving strategies and behaviors.

Feature

Are You Making the Most of MyStyle Checking?

At Mountain America, reliable and convenient checking is just the beginning. Find out what perks you may be missing out on with MyStyle® Checking.

Feature

Maximize Your Credit Card Rewards

Take advantage of your credit card benefits with these key insights. From limited-time offers to added incentives, you can enjoy tremendous value and rewards.

Announcement

In the Community: Scholarships and Grants

Find out which high school seniors were awarded a 2024 Elevate Scholarship, and learn more about the upcoming Educator Grant, available to teachers and school leaders, from the Mountain America Foundation.

Update

In Case You Missed It

Get all the news you may have missed. Choose from recent podcast episodes, inspiring member stories and important announcements from Mountain America.

Stay in the Loop

Receive notifications and other special offers on your phone.

Discover financial tips and guidance.

Receive limited-time promotions, giveaways and discounts.

Get the latest product information.

Discover a Strategic Approach to Saving Money

Sterling Nielsen

President/CEOAs we move into the second half of 2024, many of us have felt the pressure of higher-than-expected inflation rates and rising costs for mortgages, home equity loans and credit cards. These significant challenges have changed our financial landscape. Mountain America Credit Union wants to offer you some specific strategies to navigate these economic times more effectively.

Start with a financial check-in

I encourage everyone to conduct a regular financial check-in. I do this by setting aside a few minutes each month to review my current spending trends and assess whether adjustments are needed to reach my financial goals. A thorough check-in will review specific budget categories, look over debt paydown goals and explore whether there are ways to cut back or save money.

You can do this check-in on your own, with your partner or with the help of a financial coach. Our financial guides can meet with anyone—members and non-members—at no cost to provide personalized guidance tailored to your needs.

Plan ahead for emergencies

An essential category in every budget is a savings plan for the unexpected. Nothing derails a budget faster than an unexpected car repair, home expense or vet bill that requires someone to take on debt or spend differently than anticipated.

If you don’t have savings in place for these kinds of expenses, start today! Even setting aside $10-$20 per month can help build a reserve for a rainy day.

Set up alerts and notifications

Automated subscription services are convenient, but they are also an easy way to overspend. Pay attention to these charges by setting up alerts in digital banking. These notifications will keep your purchases top of mind and give you the ability to adjust or cancel unnecessary subscriptions before months of extra charges go by.

At Mountain America, our priority is to empower you with strategic savings solutions while protecting your hard-earned assets. Our team is committed to providing exceptional member service and personalized guidance to help you navigate financial challenges and avoid potential pitfalls. We are here to help you define and achieve your financial dreams.

Sincerely,

Sterling Nielsen

WATCH THE PODCAST

Don’t leave [your finances] to guesswork. You should know a couple of months out where you should be… Without that, it’s really hard to react quickly.

—Sterling Nielsen

More tips to save

1Shift your mindset

Budgeting helps you align your spending with your personal goals. Start by giving every dollar a purpose. Set up multiple savings accounts and automatic transfers to plan ahead for what is most important. This mindset shift can make budgeting feel more empowering and less confining.

2Integrate spending with rewards

Spending is a vital part of budgeting. When you spend, prioritize sticking to savvy spending habits.

- Shop for the best deals. Compare prices before making a purchase by using price comparison websites and apps. At checkout, don’t be afraid to ask if the retailer will match a competitor’s price.

- Utilize cash back and rewards programs. Capitalize on credit card and loyalty programs to make the most of your planned, everyday purchases. Coordinate your purchases with sales and promotions whenever possible.

- Consider equal payment plans. Research if your utility companies offer equal payment plans, which can make it easier to predictably manage your expenses each month. Look for other bills that are due annually or biannually—stagger saving or paying for these expenses throughout the year instead of all at once.

3Evaluate your values and aspirations

Just as we do for our physical health, taking stock of our financial situation is crucial. Reflect on your values and aspirations. Then, evaluate your financial objectives against your values to gain clarity and direction.

4Structure your savings

Look into certificate laddering, which gives you regular access to funds while providing you with the option to assess the best available dividend rates or withdraw the funds for needed expenses.

Are You Making the Most of MyStyle?

Everyone needs a reliable and convenient checking account. At Mountain America, we take our rewards checking a few steps further. If you don’t yet have MyStyle® Checking, find out what you may be missing out on! If you do have an account, be sure you’re taking advantage of these peak perks!

Top five countdown

benefits of MyStyle Checking

Our MyStyle Checking account offers benefits with an estimated monthly savings value of over $150!1

So go ahead—take a peek at this countdown of perks our members use most!

Perk #5

Perk #4

Perk #3

Perk #2

Perk #1

Perk #5

Loan rate discounts

Dreaming of a summer road trip in a new RV or car? Even a small drop in your loan rate can make a big difference in interest savings over the life of your loan.With MyStyle Checking, you’ll automatically receive a 0.25% loan rate discount on new auto, RV and personal loans.2

Perk #4

Telehealth

To help offset your healthcare expenses, Mountain America offers zero-cost telehealth services.3 This virtual healthcare program is available in English and Spanish and provides your family with:- Unlimited access to board-certified primary care physicians and licensed mental health therapists via phone or secure video chat.

- Prescription savings at most major retailers.

- Zero-copay access to licensed and credentialed doctors for non-emergency care needs.

Perk #3

Mobile phone protection

With this MyStyle Checking benefit, you’ll get up to $850 in replacement or repair coverage for your cellphone if it is stolen or damaged.4 Our mobile phone protection service:- Covers an unlimited number of phones listed on your bill.

- Includes accidental damage or theft.

- Pays up to $850 per claim minus a $50 deductible.

- Requires no preregistration of your device.

- Allows for two claims per 12-month period.

Perk #2

Dining and entertainment discounts

We haven’t forgotten about the fun! With our savings and entertainment service,3 you can:- Enjoy year-round travel and shopping discounts.

- Save money at thousands of restaurants.

- Receive discounts to activities and attractions, such as theme parks and movie theaters.

- Get coupons for a variety of local merchants.

Perk #1

Rewards

With the My Rewards program, you’ll earn points to redeem for benefits like travel rebates, gift cards, event tickets and fun experiences.5 Easily earn points when you:- Perform 40+ card transactions (debit and/or credit)—250 points.

- Make an auto or RV loan payment—100 points per loan.

- Utilize a HELOC or make a HELOC payment—100 points.

- Use bill pay—50 points.

How to access your benefits

1. Log in to online banking or our mobile app.

2. Navigate to Accounts, and then select MyStyle Benefits.

Or download the app

App StoreGoogle PlayIt's a breeze to waive the fees

Are you ready to upgrade from MyFree® Checking? It’s easy to waive the $7 monthly maintenance fee on MyStyle Checking. Simply perform 20+ monthly card transactions (debit and/or credit). You’ll be surprised how quickly they add up!

Members who are age 24 and younger or age 60 and older can also enjoy MyStyle Checking without any fees—as well as those who maintain an average daily checking balance of $10,000.

2. Rate discount valid on select new loans only. Loans on approved credit.

3. Benefit requires no-cost registration/activation.

4. The descriptions herein are summaries only and do not include all benefit terms, conditions and exclusions. Please refer to the actual Guide to Benefits for complete details of coverage, exclusions and coverage providers. Insurance products are not insured by the NCUA or any federal government agency; not a deposit of or guaranteed by the credit union or any credit union affiliate.

5. See program rules.

Maximize Your Credit Card Rewards

In today’s competitive market, optimizing your rewards credit card usage can add up to a tremendous value. Whether you’re looking to earn travel, cash back or shopping discounts, being strategic about your card usage is key.

Here are seven tips to get the most out of your credit card rewards program this year.

2. Rewards credit card purchases only. Business accounts not eligible. Limited-time offer. Offer can change or be withdrawn at any time. Offer expires July 31, 2024.

In the Community: Scholarships and Grants

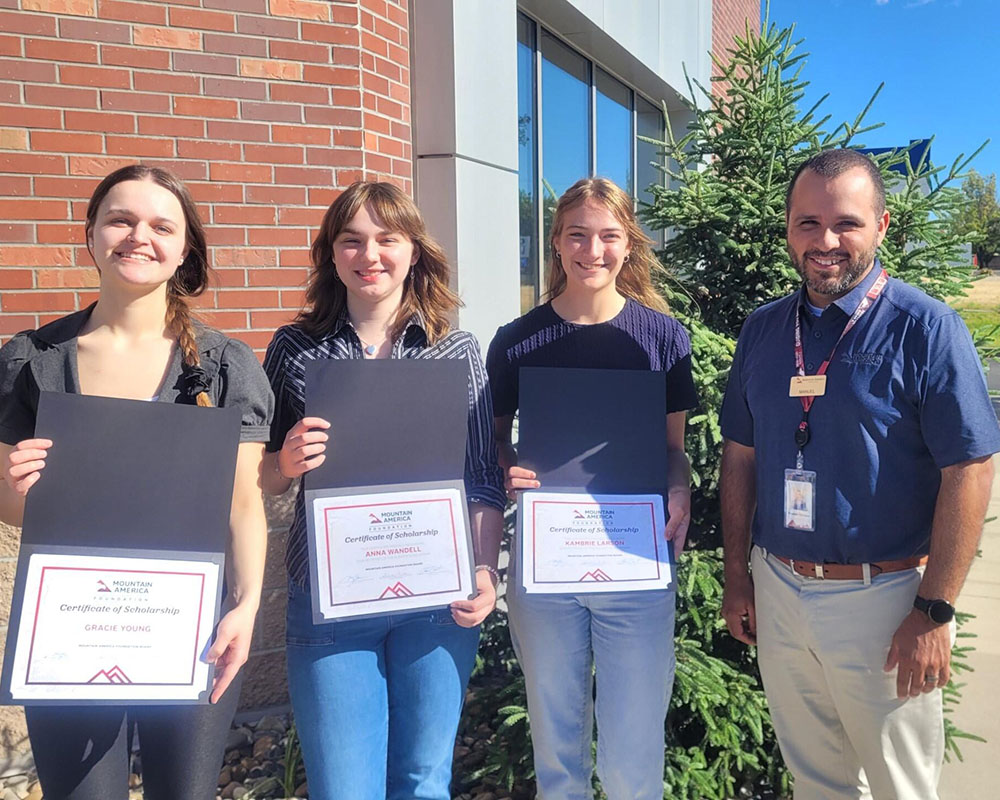

2024 Elevate Scholarship Winners Announced

The Mountain America Foundation is dedicated to supporting youth who embody our core values and serve their communities. We are thrilled to announce 2024 scholarship winners and hope these awards will guide these graduating high school seniors forward as they pursue their educational goals.

GET NOTIFIED

Our 2025 Elevate Scholarship applications will open later this year.

Sign up now

2024 Elevate Scholarship winners announced

The Mountain America Foundation is dedicated to supporting youth who embody our core values and serve their communities. We are thrilled to announce our 2024 scholarship winners and hope these awards will guide graduating high school seniors forward as they pursue their educational goals.

Get notified

Our 2025 Elevate Scholarship applications will open later this year.

Sign up now$300,000 awarded among 120 recipients

Recipients were selected from Arizona, Idaho, Montana, Nevada, New Mexico and Utah based on:

Scholastic

records

Character

Work ethic

Community

contributions

Leadership

in action

Receive up to $2,000 with our Educator Grant

Since 2016, Mountain America has awarded grants to teachers and school leaders to support learning-based projects in K-12 classrooms.

Get notified about application details and important deadlines for this school year. The application window will be open from August 7 to September 16, 2024.

Get detailsIn Case You Missed It

Enjoy a podcast, watch inspiring member stories and get helpful financial tips from our experts.

Photograph © Bryson Loughmiller | 2024 Calendar Contest Winner, June

.jpg)